Has The Housing Correction Concluded?

What a strange and wild ride it has been over the previous 12 months. We have seen interest rates lift off from record lows to levels not seen since the previous housing boom and bust. This pivot has created a perception of doom and gloom.

Let’s quickly recap before we start tossing out predictions. Rates steadily rose over 2022, as the Fed began to shift towards a hawkish stance in reaction to inflationary pressures and a nationwide housing market that has left many on the outside looking in due to an affordability crisis. Two years ago, the 30-year mortgage rate was 2.73% and the median new home price in the U.S. was $365,000. Fast forward to today, the 30-year mortgage rate is 6.13% (down from 7.25% in November) and the median new home price is $442,000. The result is a $15,000 increase in down payment, assuming 20% down, and a startling 81% increase in monthly payment amount from $1,188 to $2,149.

This created the before-mentioned “pause” that I scribed last May (Are The Tides Turning). What unfolded from there was a gradual grinding halt, as rates continued to rise, and stocks fell by the wayside. As we hit peak summer, the market was locked up with nowhere to go and no one willing to participate. By autumn the forthcoming free fall in housing prices was all but certain. Or was it?

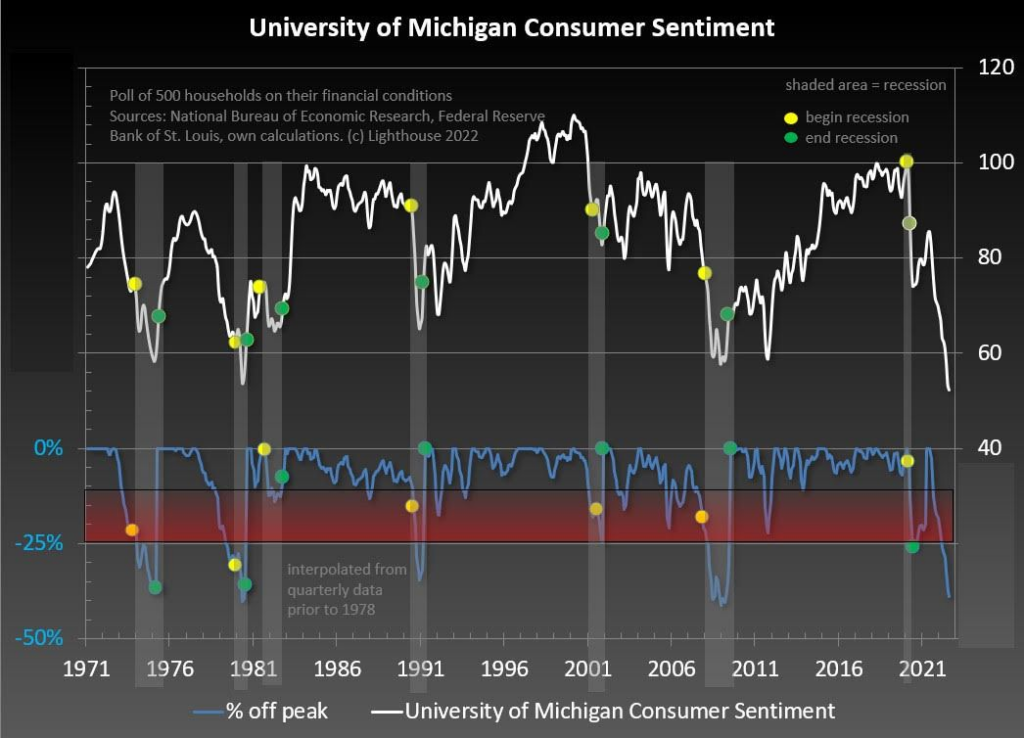

I shouted from the seat of a salesman that it was the best time to acquire a home in over a decade (Sign of the Times). Often wrong, but never in doubt! It came down to a game of psychology. The social mood for moving was so dire, the University of Michigan Consumer Confidence Survey registered a reading of 50, which is the lowest level since 1980 and often marks the end of a recession, not the beginning.

This is textbook consumer sentiment. We went from a no guts, no glory market to a standstill overnight. A typical cycle for an asset class correction will last 18-24 months, not a handful, and with minimal to no pricing pressure felt in our market it wasn’t enough to get people back and buying. Yet here we are on the verge of putting the dismal market behind us. Why?

Since peaking in June 2022, U.S. home prices have fallen 2.4%. That puts us just below April 2022 levels IF U.S. home prices fall 10% peak-to-trough, it’d take prices back to Oct. 2021 levels. While it’s way too early for forecasters to say home prices have bottomed out, relative to the 2nd half of 2022, nominal home prices look to be stabilizing, financial conditions continue to loosen and loan demand continues to grow despite elevated yields. The mortgage purchase index from MBA Mortgage has risen by 29% over the past two weeks, which is the fastest two-week change since the 4th quarter of 2008, which is coming off one of the lowest levels, read demand, in history. Simply put, demand for mortgages hit an extreme low this fall.

It feels like we have bottomed out in the housing market for the foreseeable future.