What’s Happening in the Housing Market

What a strange and interesting journey it has been over the previous 12 months. We have been exposed to a pandemic and through that stress test, it has shifted how we live, work, and function. It has been met with sadness and the loss of life, but it also has provided many with perspective on how they want to live their life moving forward and people are placing a premium on what they value. When is the last time we hit the pause button and re-evaluated all the finite details that collectively make up the carousel we put our lives on?

How has this newfound fondness for introspection unfolded within my business? Activity. Simply put, people are taking control of what they want and are pursuing it. The housing boom we have been emerged in since it began in 2012 was born out of a lack of supply and increasing demand. Many were left underwater from prices paid heading into 2008 when the tides turned and not able to maneuver, which created a tight market to operate within for home buyers.

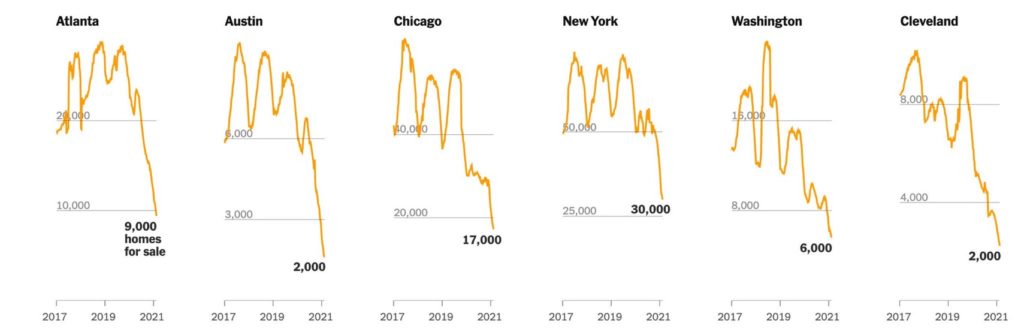

This window is now so narrow we are on the verge of another bubble. Why? It’s a confluence of factors that created the perfect storm. Interest rates hit an all-time low of 2.65% on a 30-Year mortgage rate in January of this year, stocks climbed back and are hovering at all-time highs, freedom, and flexibility to work remotely is part of the new normal, and personal income spiked higher with two rounds of stimulus payments. Interest rates have spiked recently, and this will do is suck more people into the deep end of the pool for fear of missing out, as witnessed by current inventory across the country.

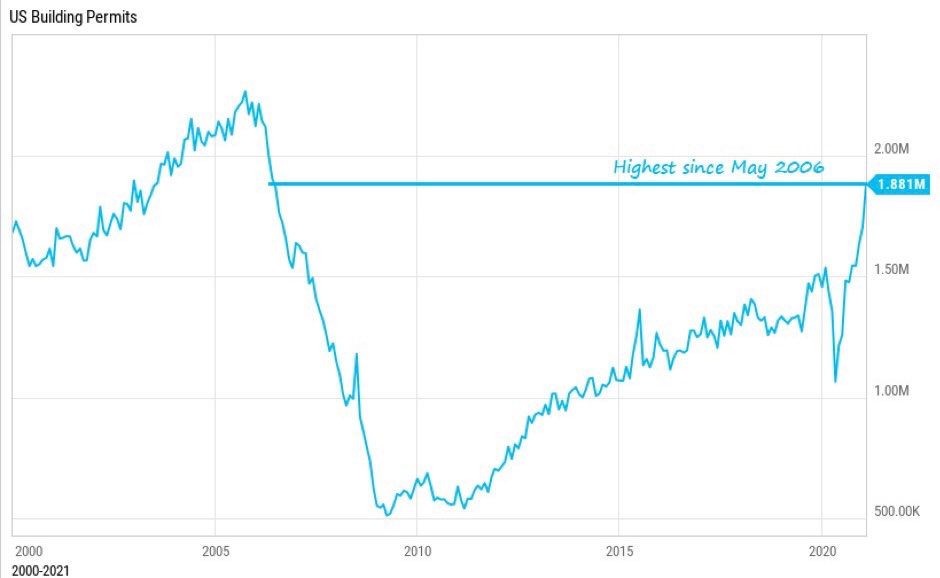

This will keep the housing market very hot. In fact, homes are not just selling within hours, it’s that they are selling for $40,000 over the listing price on a $400,000 home. Throughout most of history, US Home prices tracked inflation rates relatively closely. That relationship diverged during the housing bubble when price appreciation exceeded inflation by 99% at the end of 2005. The surge higher during the current boom brings back to those levels. We are also seeing building permits for new contraction homes back to 2006 levels.

So where do we go from here? Covid-19 hospitalizations in the US have declined 51 days in a row, down 67% from their peak on Jan 6. The US has averaged 2.1 million vaccine shots per day over the last week, a new high. 16% of the population has now been given at least 1 dose. With J&J rolling out this week, the pace should continue to increase. What this means is that people returning to the lives they once new is within reach and if we look at total US vehicle sales, which is back to pre-covid levels, the checkbooks and credit cards are about to come out in full force and people are going to be active. The pandemic has been an enormous economic boost for the vast majority of households as more than one hundred million Americans who never lost their job received free money payments.

What we could see is an explosion in many different markets. Retail, travel and leisure, housing, really anything consumer-driven should experience a sort of roaring 20’s excitement, which will push the envelope on valuations. One indicator that I am watching is the money supply or M2. The US Money Supply grew 25% in 2020, the largest annual increase in US history by a wide margin and most since the 1970s when it increased twice by more than 13%, which is the last occasion we saw rapid inflation hit us over the head. What are the unintended consequences and how are they ready starting to seep into the system? The most notable commodity tied to the housing market is lumber, which is up 100% since October. But be careful, this too shall pass and when it does, many will be left without a chair.